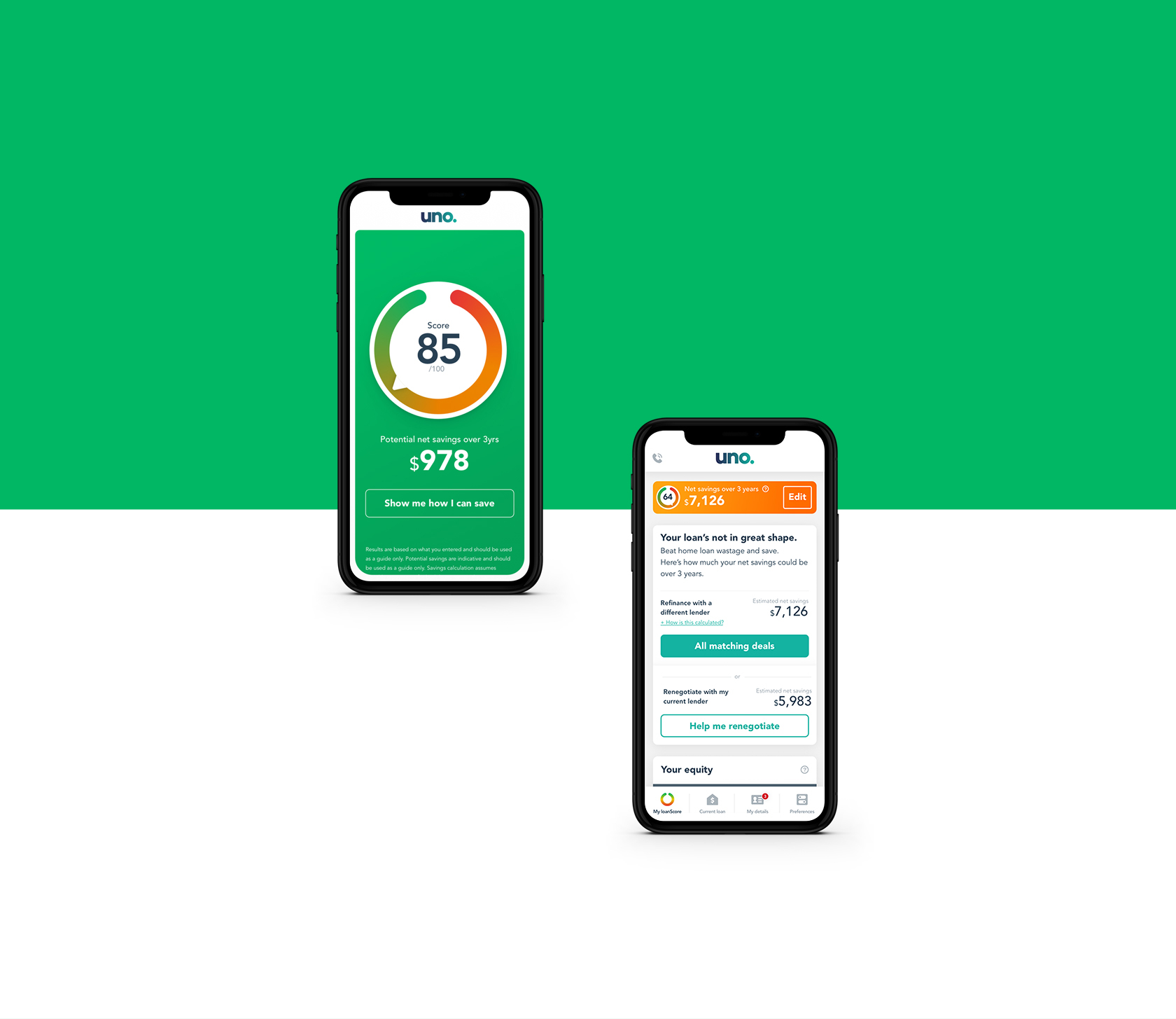

uno. loanScore

uno's mission is to grow the prosperity of Australian households by helping them find, and stay on, the best value home loan for the whole life of the loan

uno asked North to lead a D.I.D.I.T. Design Sprint to help develop a new retention service to address the naturally cyclical behaviour of buying and remortgaging your home.

Sprinting to success

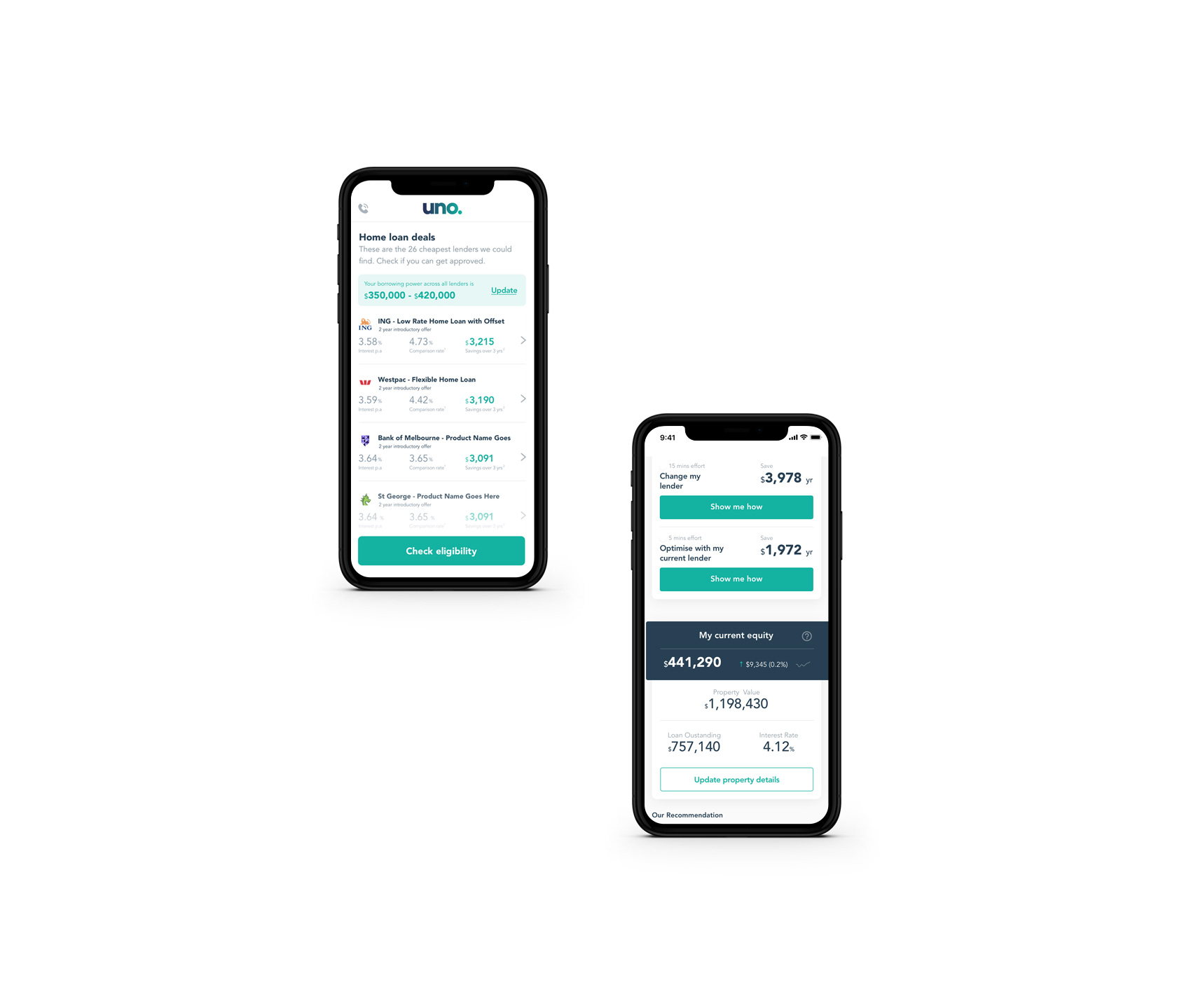

We observed an entire industry constantly shouting at customers to tell them to refinance but research indicated most don’t even know their interest rate let alone whether they are on a good deal or not.

We needed to find a way to engage customers around their single biggest household expense that was simple and provided upfront and ongoing value with minimal effort. In parallel not all interest rates are available to all people or situations so we needed to ensure we only compared your loan to relevant products/lenders to answer the question “is your loan any good or not?”

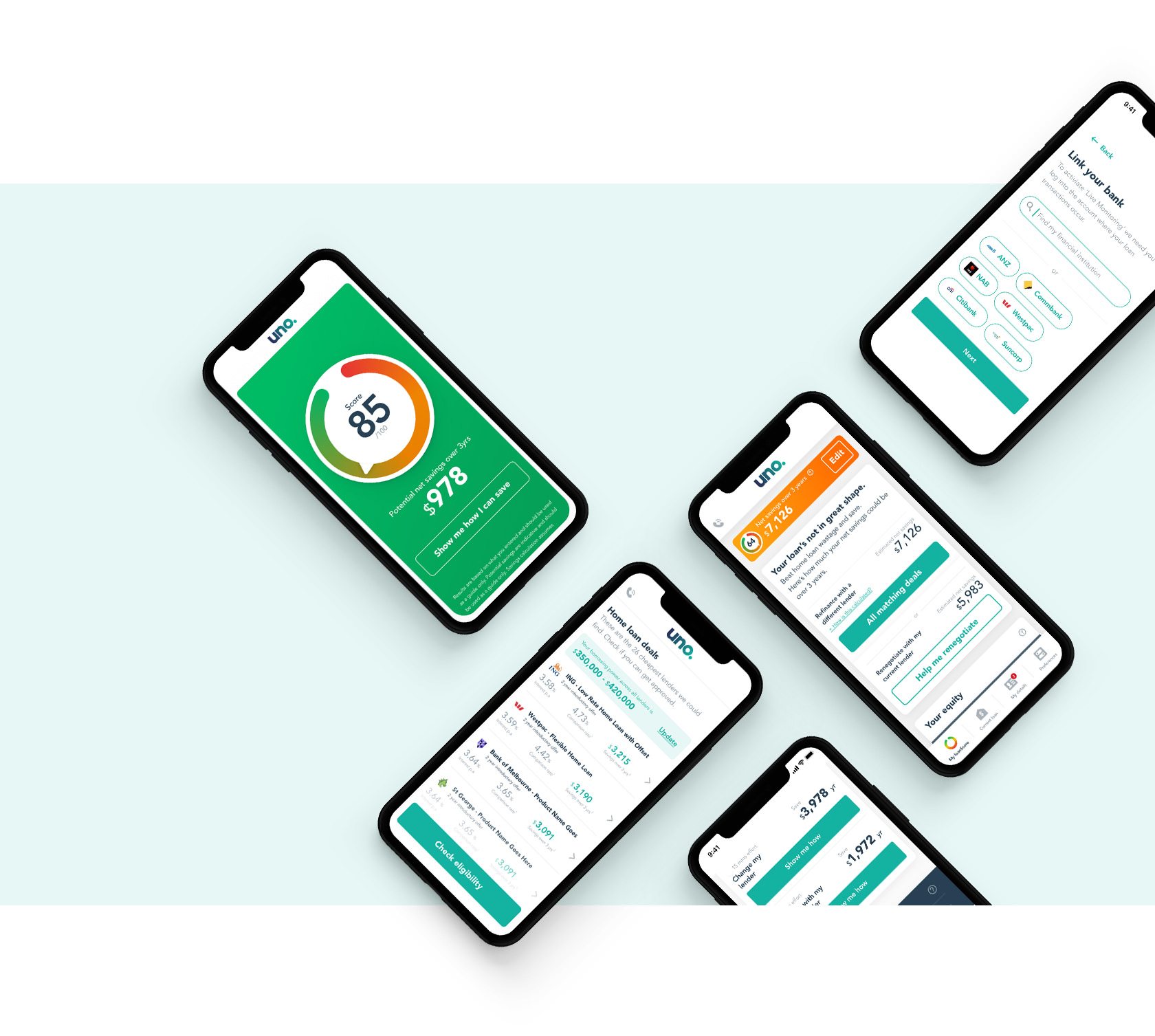

North conducted a 5 day design sprint where the collaborative working group of North and uno were able to create a new service and offering called ‘loanScore’. The loanScore™, is an innovation in home loans that enables any person with a home loan to answer a fundamental question ‘is my current home loan any good or not’. For less than 90 seconds of work you can have your loan continuously monitored for free!

Chris Abbott, Managing Partner at North said…

“The D.I.D.I.T. Design Sprint is an innovation technique that accelerates strategic thinking and product design. We started by understanding the business objectives and conducting customer research. With this as a foundation we followed an accelerated innovation process for 5 days. Working with experts across the uno business, from business leaders, designers and marketers we ran through a set of rigorous activities to help us address the customer problem identified by uno. At the end of 4 days we had a (sometimes more than one) clickable digital prototype of the idea we wanted to test. On the 5th day we tested with real uno customers that fitted the profile.

The feedback from testing helped evolve the solution over the following weeks until we landed on a version of loanScore that you see today.”

After the initial design sprint, the North team helped develop the digital experience and interface in collaboration with uno’s in-house design team.

North has continued to partner with uno on the optimisation of loanScore™ since its release.

Vincent Turner

Founder

uno Home Loans

"At uno we're passionate about ensuring all Australians not only get a great home loan up front, but also stay on a great deal through the life of their home loan. We designed a digitally led proposition called ‘Active Home Loan Management’, to deliver this and have unique technology at the heart of it called LoanScore."

Good Design Award

North and uno Home Loans are proud to announce it has received a Good Design Award in the Digital Design Web Design and Development category for it’s loanScore™ tool, in recognition for its outstanding design and innovation.

More than 55 Good Design Awards Jurors evaluated each entry according to a strict set of design criteria which covers ‘good design’, ‘design innovation’ and ‘design impact’, and found uno’s loanScore tool to demonstrate excellence in all categories.

Full case study coming soon.

Our client partners

We worked with

Our partners are also our friends. We help them to achieve their goals, and they help us to stay sharp.